Perhaps the only downside to using Dave is that you can only request a maximum payday advance of $100. Thankfully, there are plenty of apps like Dave that allow you to borrow a larger amount. You can use a combination of these apps to help you gain better control over your finances, teach you valuable ways to save money, and borrow cash for emergencies.

Cash Advance Apps Like Dave

1. Even

Even is one of the leading financial planning apps offering cash advances of as much as 50% of the money you have already earned. However, you must work for a qualifying employer to compare the financial plans available on this app. If you want to withdraw cash on the same day, visit your nearest US Walmart. It is a costlier app compared to Dave as you need to pay $8 for a monthly Even Plus membership. Unlike Dave, Even allows you to check your bank account thrice a day. It also notifies you with an “okay to spend” amount for your bills. The app also allocates a specific amount from your bank account so that you don’t face financial troubles towards the month-end.

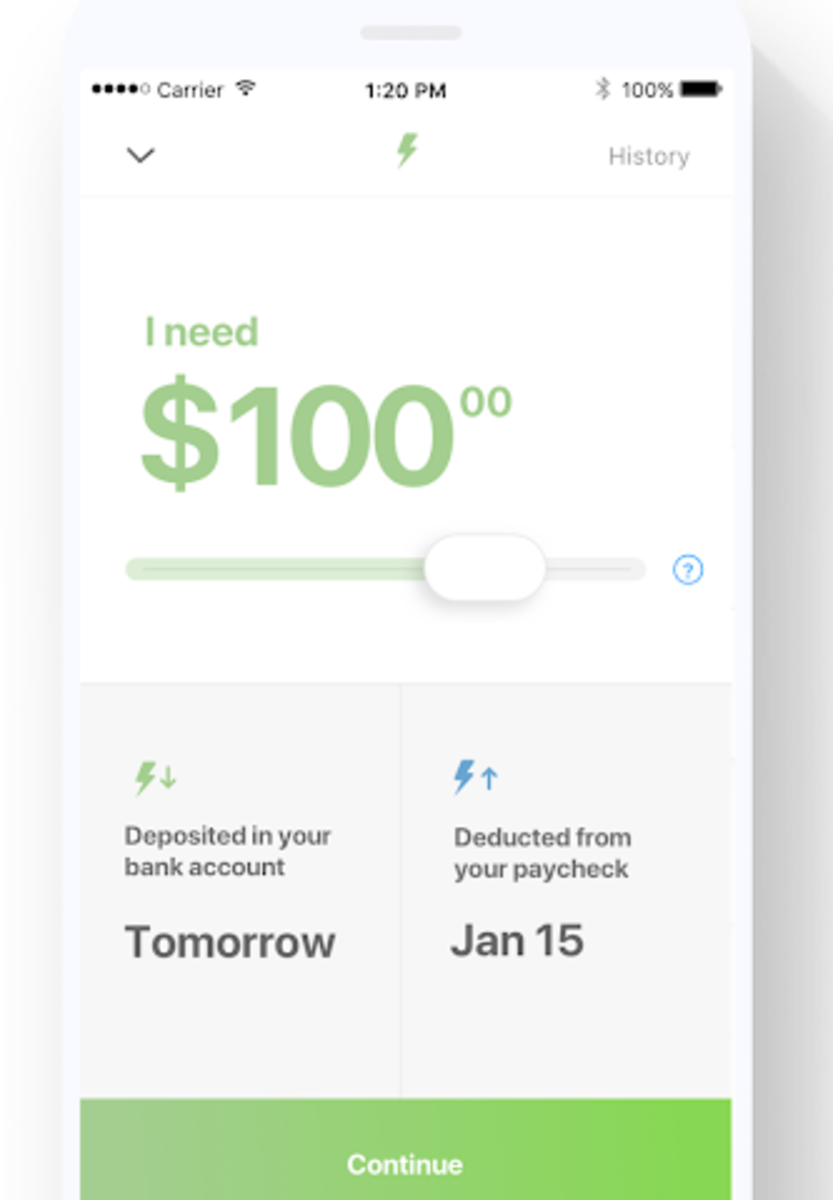

2. Earnin

Earnin works almost like Dave, but it doesn’t involve any membership fees. It also allows you to borrow money, depending on the number of hours you have already worked. For example, you can borrow as much as $500 per day if you have amassed a considerable number of work hours. Moreover, you don’t need to go anywhere to collect your money. If you want to take out an advance, just use its Lightning Speed program. The app will deposit the cash in your bank account within one business day. Earnin also comes with a Balance Shield program that prevents overdraft fees. But you need to maintain regular working hours to qualify for an advance withdrawal and Lightning Speed program. Also, you should enable your location services or upload your work schedule to take out an advance.

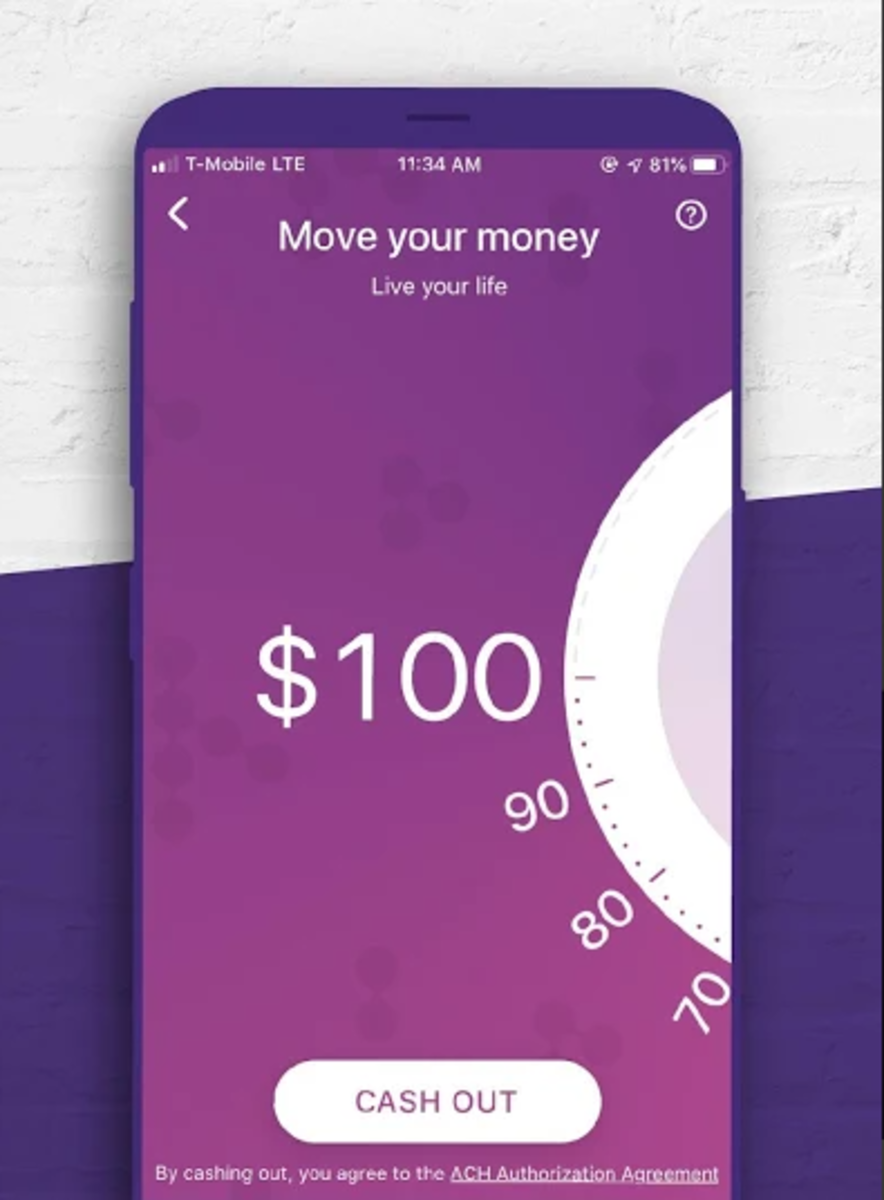

3. Brigit

Brigit is an excellent cash advance app. Unlike Dave, Brigit provides a more substantial cash advance of up to $250. It also comes with an automatic withdrawal option if you notice that your bank balance is getting low. Brigit analyzes your account thoroughly and predicts your spending habits to prevent overdrafts. It also allows you to extend your payment due date if you can’t repay on time. Despite its many benefits, Brigit is one of the most expensive cash advance apps available right now. Compared to Dave, which only costs $12 a year, Brigit will set you back $120 annually. Also, its funding speed is slightly slower than Dave, and you need to match a long list of eligibility criteria. Moreover, you need to make more than $1,500 per month to qualify for this app.

4. Branch

Branch is much more than just another pay advance app. It allows you to manage your work life, including switching shifts, chatting with your coworkers, and tracking your work hours. In addition to all this, you can get $500 per pay period in increments of $150 per day, depending on the hours you have worked. Branch is the closest app to Dave in terms of flexibility and speed, but it doesn’t charge anything for its membership. You can take out a chunk of money as an advance from your earnings on the same day. The only catch is that your employer also needs to have an account with Branch. Otherwise, the app will put you on their waiting list until your employer registers on this application. Also, you need to upload your working hours and the advance is only applicable for the period you have worked.

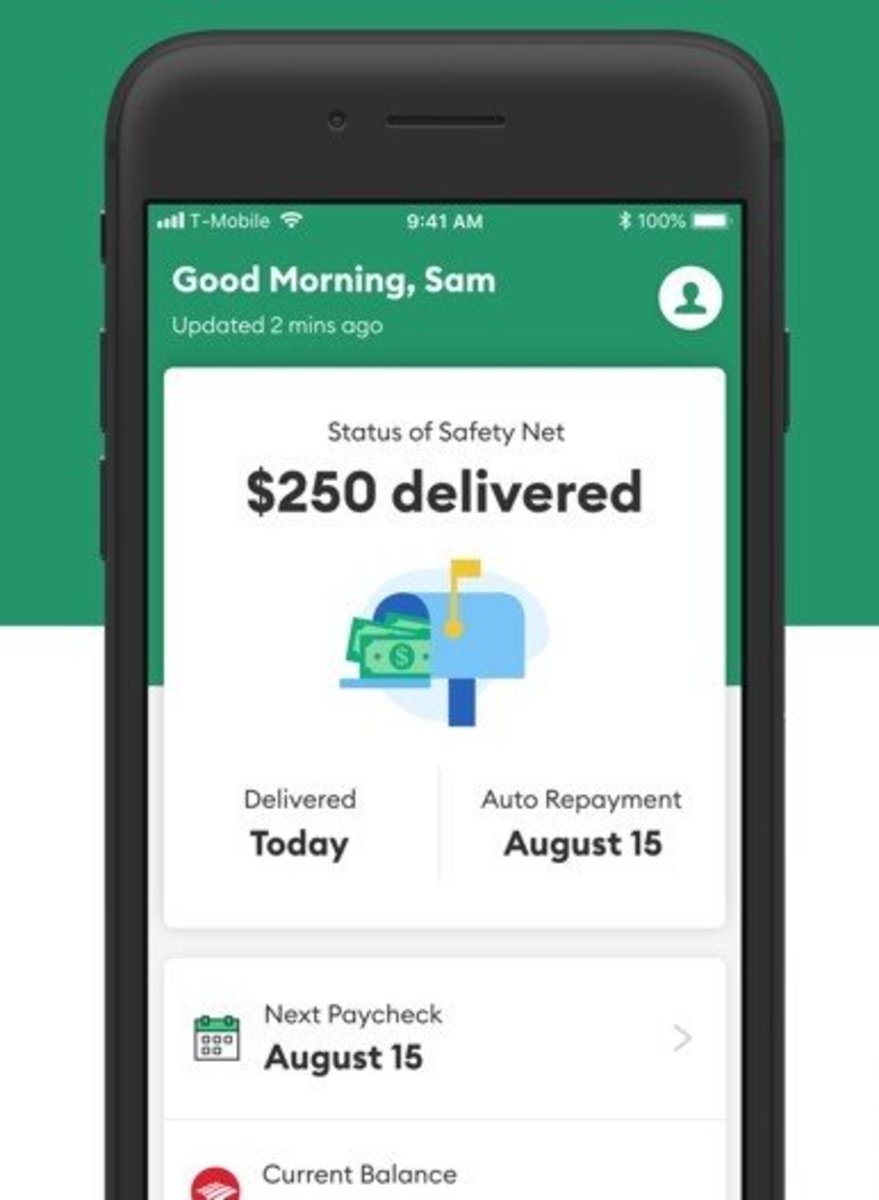

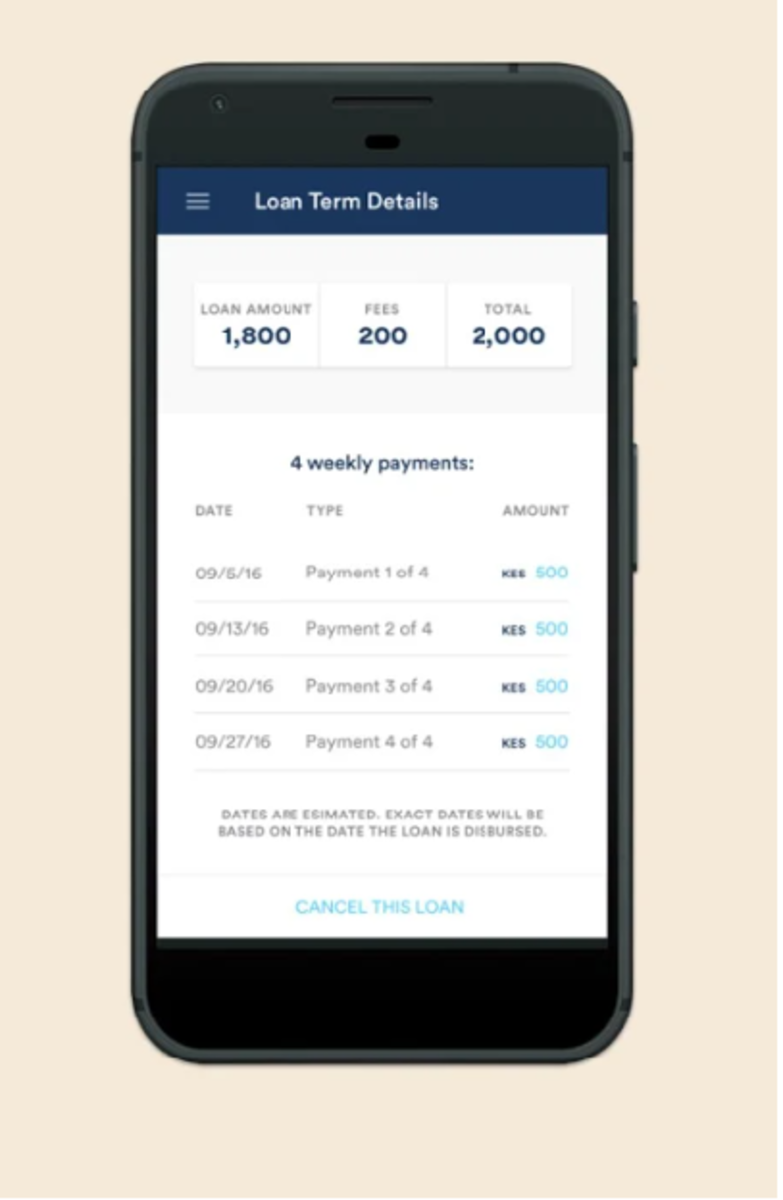

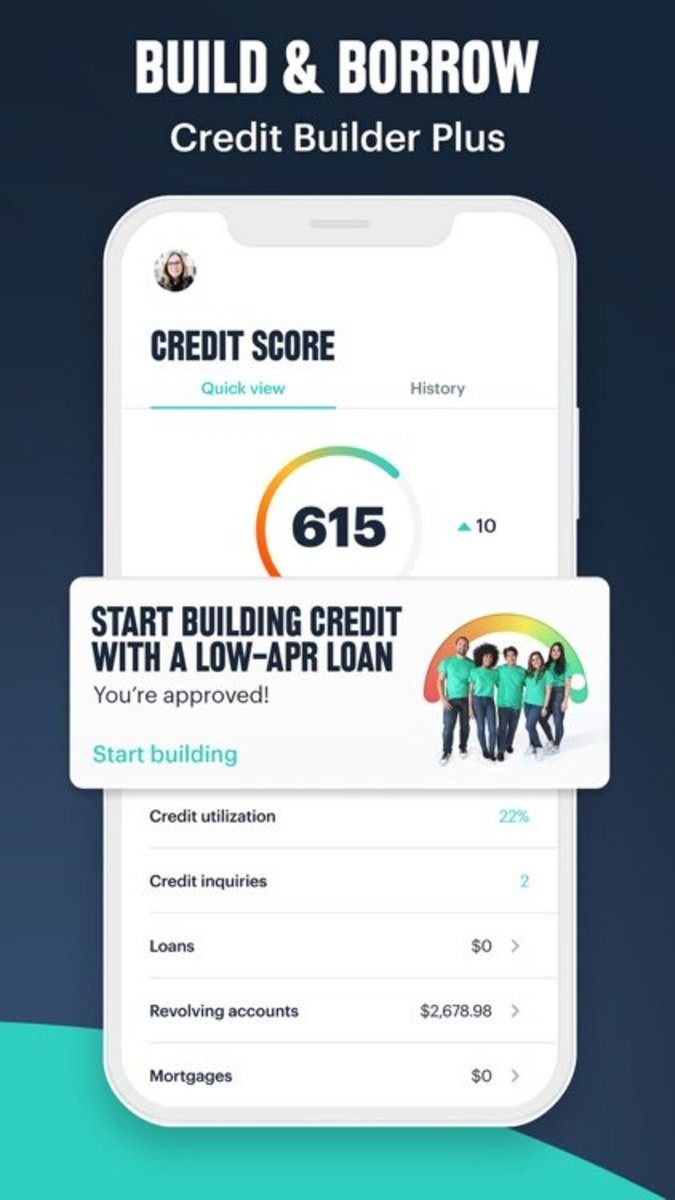

5. MoneyLion

Keep in mind that for this app you need to have a checking account at MoneyLion to get pay advances. This app is rigorous when it comes to providing pay advances to its users. You can get up to a $250 advance per day. The great thing about MoneyLion is that the app will automatically transfer your cash to your bank account within the same day. You don’t need to worry about any interest or borrowing fees. Plus, it allows you to check your bank account and access multiple services, including monitoring your free credit. However, this app doesn’t work in a few states, such as Montana, Iowa, Indiana, Vermont, Nevada, and Nebraska. Additionally, you can only borrow 10% of your direct deposit for every pay period.

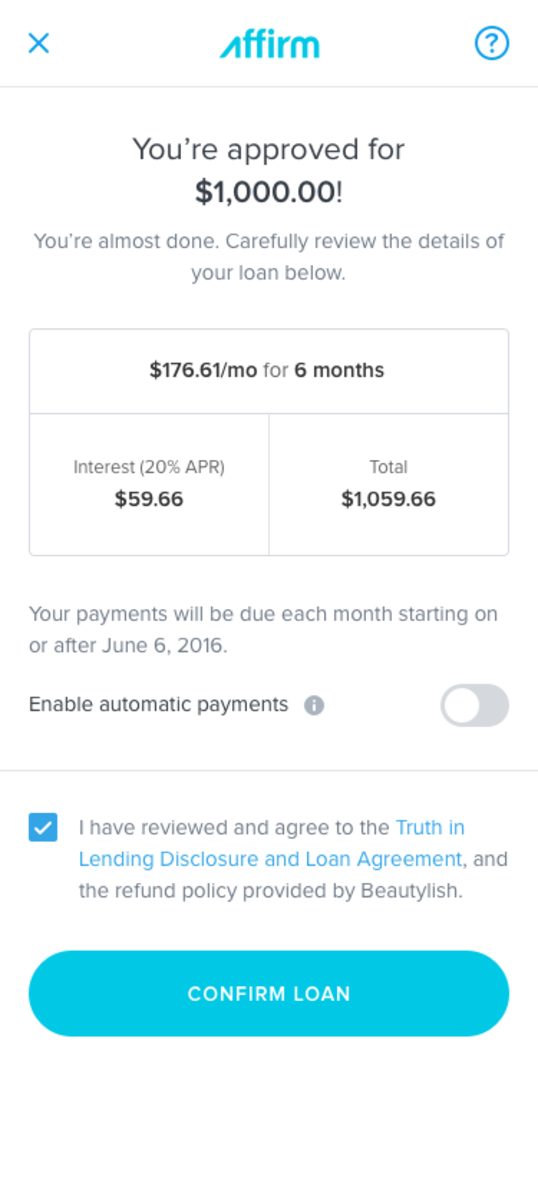

6. Affirm

Affirm is one of the easiest-to-use finance applications that allows you to divide your online purchases so that you can make easy monthly payments. It also works as your virtual credit card with no hidden fees. All you need to do is fill out an application on the app for a real-time decision, and choose the payment schedule that suits your work. Affirm lets you purchase anything from anywhere. Once you install this app and enter your purchase amount, it can set up a monthly payment schedule that meets your spending habits. Moreover, you can send money to others using Affirm, which only takes a few seconds.

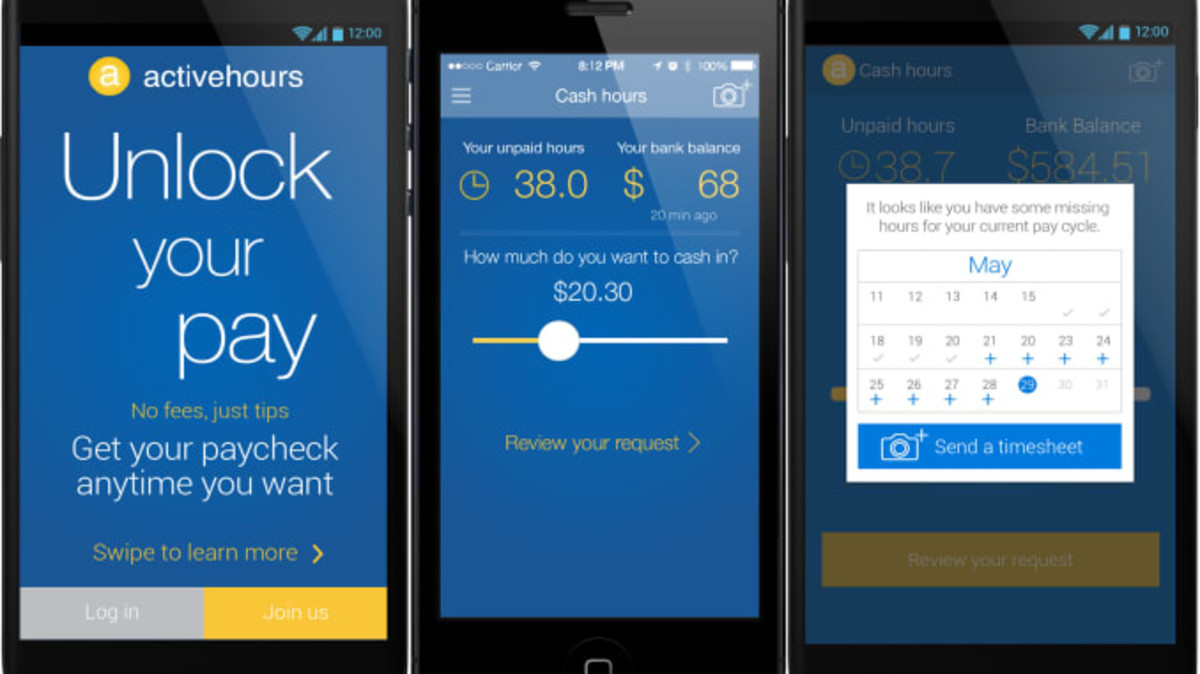

7. Activehours

Unlike other cash advance apps that take at least one business day to transfer your money, Activehours pays you as soon as you finish your work. This application works for almost all business sizes, thus making it easier for workers to get money instantly instead of waiting for their payday. However, your employer needs to have an account at Activehours. The app will ask you about your employer and your working hours. You also need to connect your bank account with this app. Another advantage of using Activehours is you can withdraw as much as $100 from your paycheck every day. There are no fees or hidden charges for any withdrawals, making it a handy app for daily wage-earners. In addition to getting instant payments, you can also track your expenses.

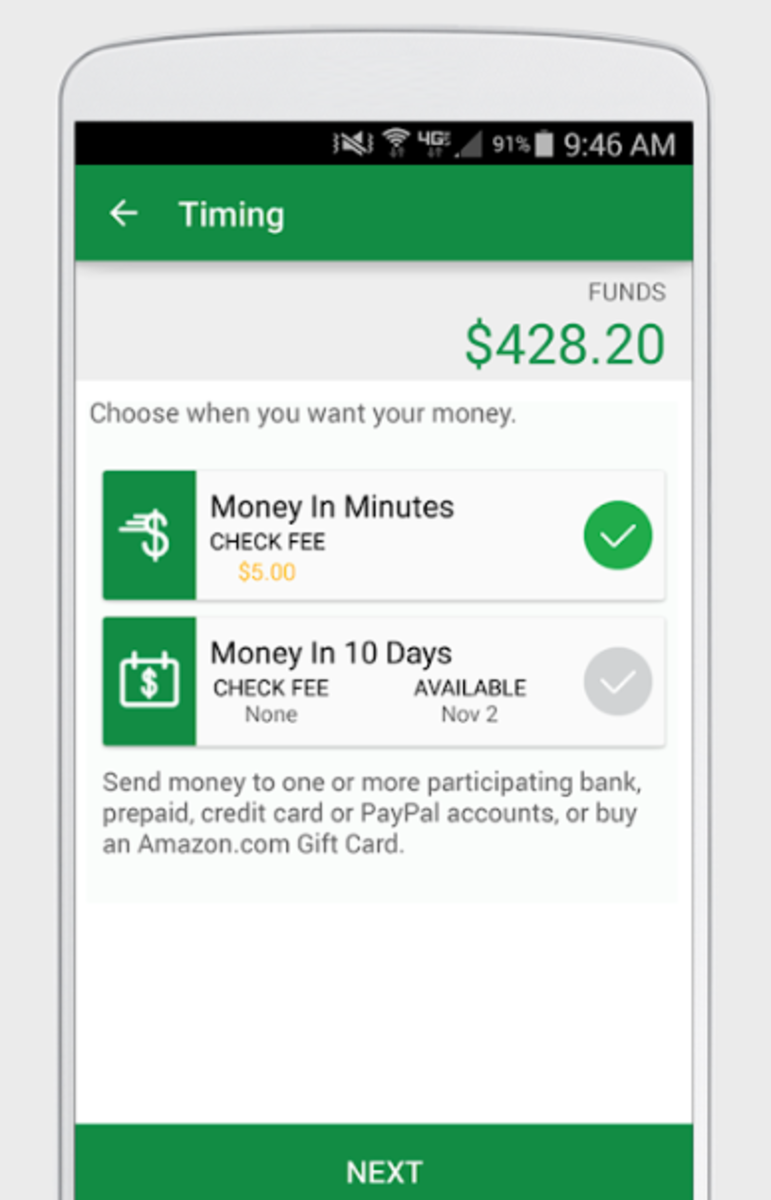

8. Ingo Money

Ingo Money provides a host of features like Dave, such as getting cash paychecks, personal checks, and business checks, anytime, anywhere. In terms of speed, it has the upper hand over Dave. Ingo Money transfers money within minutes. You don’t need to wait for a business day to take out an advance.

Who Should Use These Dave Alternatives?

As long as you have a steady paycheck, you should be a good candidate for these apps. While these apps similar to Dave can you help you get out of a financial crisis from time to time, it’s still recommended to assess your spending habits. Getting some quick cash to pay for unforeseen expenses until your next payday can be helpful, but you’d want to establish a solid foundation for your finances by cutting your expenses and boosting your income. This article is accurate and true to the best of the author’s knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters. © 2020 Carson McQueen